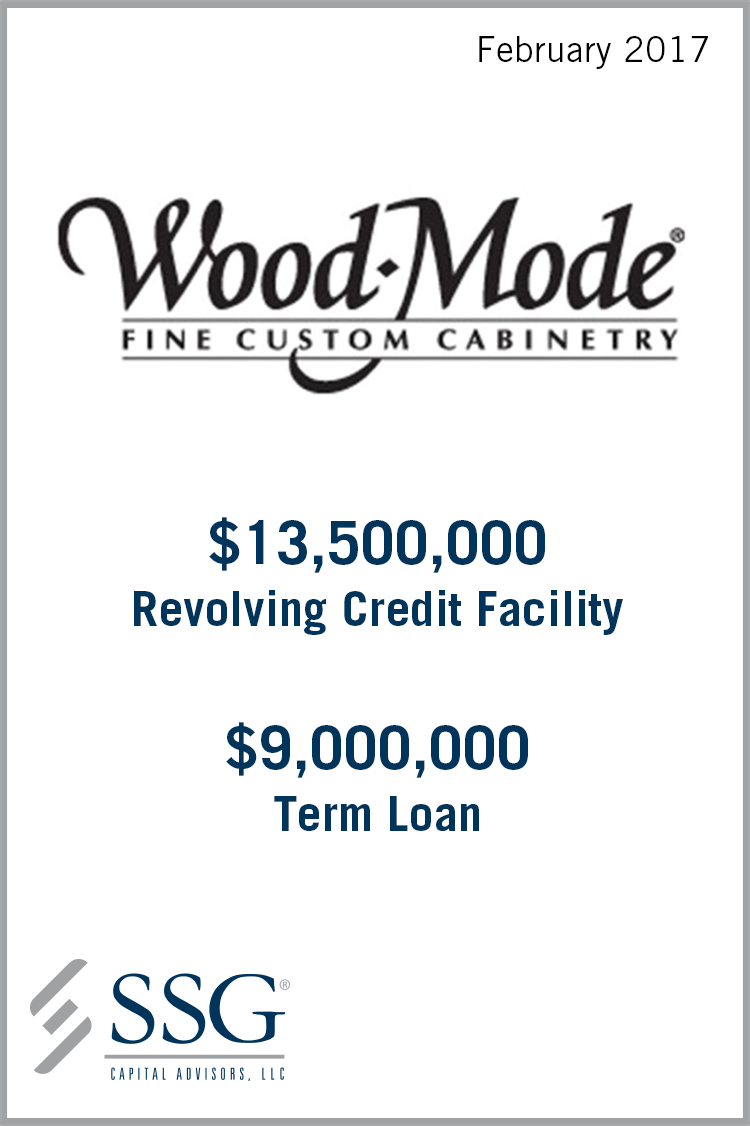

Wood-Mode Incorporated

Client Profile

Wood-Mode Incorporated (“Wood-Mode” or the “Company”) is a manufacturer of high-end custom cabinetry crafted for use in kitchens, bathrooms, closets/wardrobes, entertainment areas, offices and hobby areas or any other household location requiring storage. Wood-Mode markets and sells its products under two well-known and respected brand names, Wood-Mode and Brookhaven. The Company’s design portfolio offers a diverse collection of styles inspired by classical motifs from around the world, as well as American classics. For 75 years, the Company’s ever-evolving selection of wood species, door styles, fine furniture-quality finishes and creative custom design elements have offered consumers the freedom and flexibility to create a truly personalized living space.

Situation

Wood-Mode experienced a significant improvement in performance in fiscal year (“FY”) 2015 and successfully implemented a number of operational initiatives in FY 2016 that positioned the Company for future growth. However, Wood-Mode’s capital structure did not provide adequate liquidity to fund the Company’s seasonal working capital requirements and anticipated Q2 FY 2017 production ramp-up.

Solution

SSG was engaged to refinance the Company’s existing credit facility and secure additional availability to fund the Company’s near-term and projected cash needs. SSG solicited interest from a targeted list of traditional and alternative lenders and received multiple term sheets. A split-lien deal was determined to be the best solution, with one lender providing a new revolving line of credit (the “Revolver Lender”) and another lender providing a new term loan (the “Term Loan Lender”). SSG’s experience in identifying lenders and running an expedited financing process resulted in a solution for the Company that provided additional availability to finance ongoing operations and future initiatives.